https://en.sputniknews.africa/20240616/russian-gas-market-share-surges-surpassing-us-lng-imports-in-europe-1067070787.html

Russian Gas Market Share Surges, Surpassing US LNG Imports in Europe

Russian Gas Market Share Surges, Surpassing US LNG Imports in Europe

Sputnik Africa

The EU's move to decrease reliance on Moscow led to increased energy costs and shortages. While the US became Europe's primary gas supplier in September 2022... 16.06.2024, Sputnik Africa

2024-06-16T15:35+0200

2024-06-16T15:35+0200

2024-06-17T14:35+0200

international

united states (us)

europe

russia

european union (eu)

sputnik

liquefied natural gas (lng)

sanctions

us sanctions

anti-russian sanctions

https://cdn1.img.sputniknews.africa/img/07e8/06/10/1067070968_0:140:3144:1909_1920x0_80_0_0_3c8599621e3e7e76e5d015f7228ac983.jpg

The share of Europe's gas imports from Russia overtook US supplies for the first time in almost two years in May, the Financial Times reluctantly acknowledged.Despite a much-touted EU intention to wean itself completely off Russian energy as part of the West’s sanctions campaign, Russia’s piped gas and LNG shipments accounted for 15 percent of total supply to the EU, UK, Serbia, Bosnia and Herzegovina, North Macedonia, and Switzerland, according to data provided by Independent Commodity Intelligence Services (ICIS).LNG from the US made up just 14 percent of supply to the European market in May – the lowest level since August 2022, as per ICIS.The publication rushed to blame “one-off factors” for the trend, underscoring “the difficulty of further reducing Europe’s dependence on gas from Russia.” It added that several East European countries still rely on imports of Russian energy. An outage at a major US LNG export facility was also cited as one of the factors involved.ICIS speculated that soon Russia would be able to ship LNG to Asia via its Northern Sea Route, thus reducing the amount sent to Europe. It also suggested that overall US LNG production was set to grow, with “new capacity affecting the global market by the end of the year.”Furthermore, FT pointed out that Kiev has no intention of extending a five-year deal with Gazprom on the transit of Russian gas to Europe when it expires later this year. Ukraine has also struck a deal with US-based liquefied natural gas (LNG) developer Venture Global to buy unspecified amounts of liquefied natural gas from the gas firm's Plaquemines LNG facility in Louisiana throughout 2026. These developments were also seen as affecting the market.After the US availed itself of the opportunity to overtake Russia as a supplier of gas to Europe in September 2022, it has accounted for about a fifth of the region’s supply since 2023, the publication noted.The disruption of Russian gas supplies due to short-sighted Western sanctions on Moscow over Ukraine has left Europe grappling with spiraling inflation and surging energy bills. The costs of liquefied natural gas (LNG) exports from the US have added to the pressures on European households’ budgets. Sputnik's calculations based on Eurostat data revealed late last year that the European Union has been forced to overpay some €185 billion for gas imports since it jumped on the sanctions' bandwagon. Meanwhile, the United States has been raking in profits estimated to be worth €53 billion.Russia cautioned that sanctions against it, including attempts to part ways with Russian energy imports, would have long-term backfiring consequences. The warning fell on deaf ears, while Western countries and their allies were left facing an energy crisis. Overall, the sanctions in the West have triggered everything from raging inflation and recession fears to looming deindustrialization, with Germany being hit the hardest.

united states (us)

europe

russia

Sputnik Africa

feedback@sputniknews.com

+74956456601

MIA „Rossiya Segodnya“

2024

News

en_EN

Sputnik Africa

feedback@sputniknews.com

+74956456601

MIA „Rossiya Segodnya“

Sputnik Africa

feedback@sputniknews.com

+74956456601

MIA „Rossiya Segodnya“

international, united states (us), europe, russia, european union (eu), sputnik, liquefied natural gas (lng), sanctions, us sanctions, anti-russian sanctions

international, united states (us), europe, russia, european union (eu), sputnik, liquefied natural gas (lng), sanctions, us sanctions, anti-russian sanctions

Russian Gas Market Share Surges, Surpassing US LNG Imports in Europe

15:35 16.06.2024 (Updated: 14:35 17.06.2024) The EU's move to decrease reliance on Moscow led to increased energy costs and shortages. While the US became Europe's primary gas supplier in September 2022, the recent shifts in supply dynamics underline ongoing challenges in the energy market.

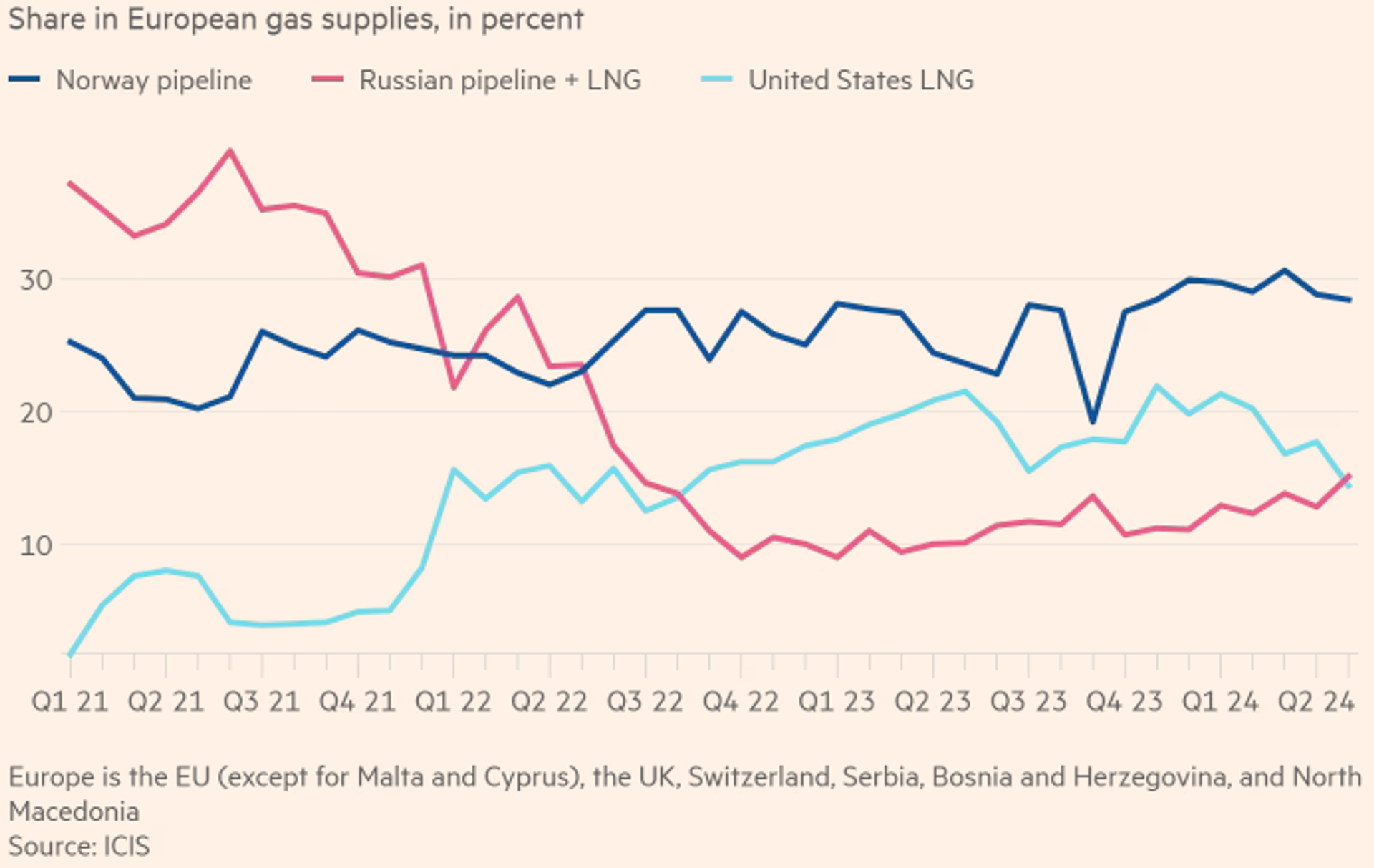

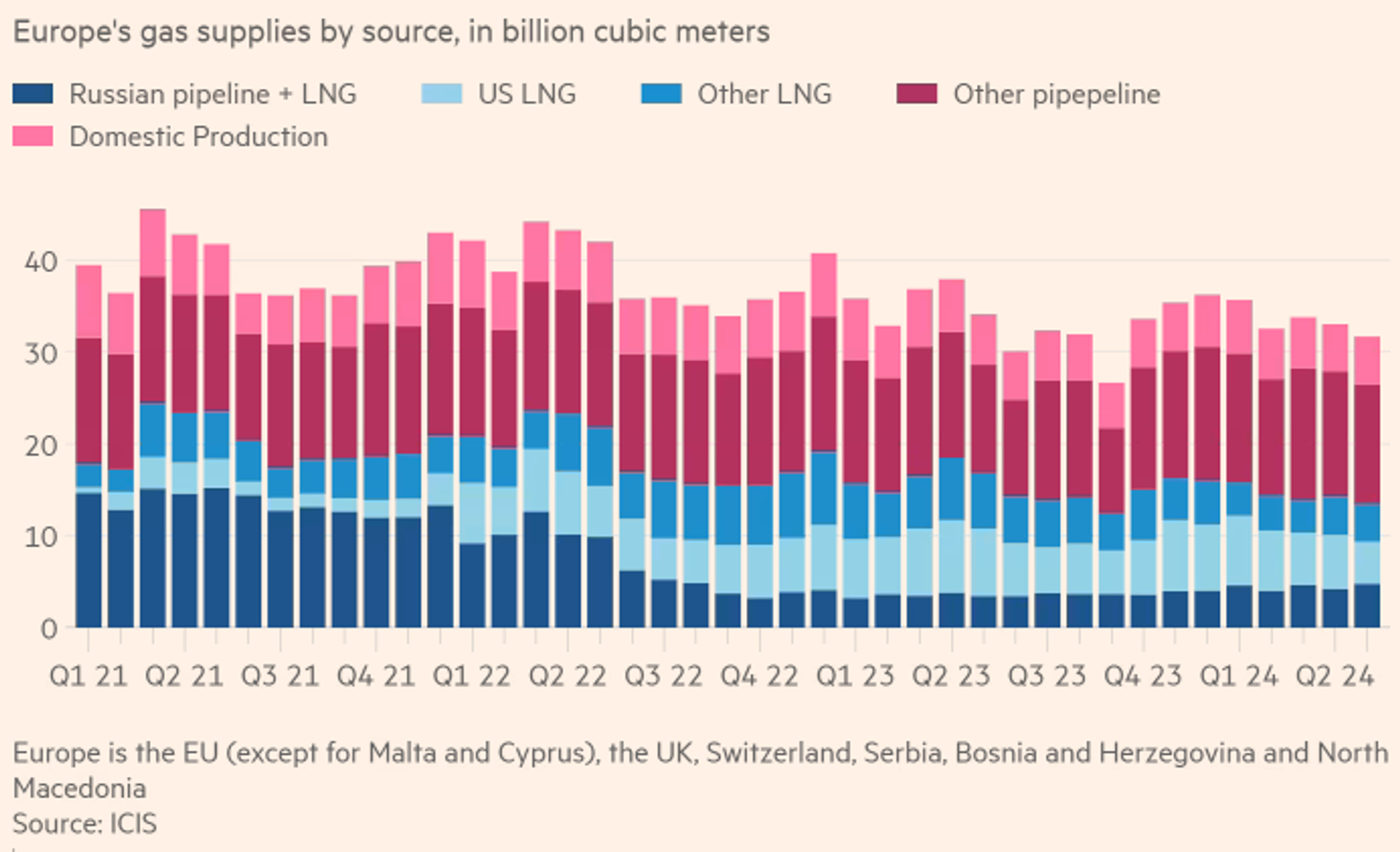

The share of Europe's gas imports from Russia overtook US supplies for the first time in almost two years in May, the Financial Times reluctantly acknowledged.

Despite a much-touted

EU intention to wean itself completely off Russian energy as part of the West’s sanctions campaign,

Russia’s piped gas and LNG shipments accounted for 15 percent of total supply to the EU, UK, Serbia, Bosnia and Herzegovina, North Macedonia, and Switzerland, according to data provided by Independent Commodity Intelligence Services (ICIS).LNG from the

US made up just

14 percent of supply to the European market in May – the lowest level since August 2022, as per ICIS.

The publication rushed to blame “one-off factors” for the trend, underscoring “the difficulty of further reducing Europe’s dependence on gas from Russia.” It added that several East European countries still rely on imports of Russian energy. An outage at a major US LNG export facility was also cited as one of the factors involved.

“It’s striking to see the market share of Russian gas and [liquefied natural gas] inch higher in Europe after all we have been through and all the efforts made to decouple and de-risk energy supply,” Tom Marzec-Manser, head of gas analytics at the consultancy ICIS, was cited as saying.

ICIS speculated that soon Russia would be able to ship LNG to Asia via its Northern Sea Route, thus reducing the amount sent to Europe. It also suggested that overall US LNG production was set to grow, with “new capacity affecting the global market by the end of the year.”

Furthermore, FT pointed out that Kiev has no intention of extending a five-year deal with Gazprom on the transit of Russian gas to Europe when it expires later this year. Ukraine has also struck a deal with US-based liquefied natural gas (LNG) developer Venture Global to buy unspecified amounts of liquefied natural gas from the gas firm's Plaquemines LNG facility in Louisiana throughout 2026. These developments were also seen as affecting the market.

After the US availed itself of the opportunity to overtake Russia as a supplier of gas to Europe in September 2022, it has accounted for about a fifth of the region’s supply since 2023, the publication noted.

The disruption of Russian gas supplies due to

short-sighted Western sanctions on Moscow over Ukraine has left Europe grappling with spiraling inflation and surging energy bills. The costs of liquefied natural gas (LNG) exports from the US have added to the pressures on European households’ budgets.

Sputnik's calculations based on Eurostat data revealed late last year that the European Union has been forced to overpay some

€185 billion for gas imports since it jumped on the sanctions' bandwagon. Meanwhile, the United States has been raking in profits estimated to be worth

€53 billion.

Russia cautioned that sanctions

against it, including attempts to part ways with Russian energy imports, would have long-term backfiring consequences. The warning fell on deaf ears, while Western countries and their allies were left facing an energy crisis. Overall, the sanctions in the West have triggered everything from raging inflation and recession fears to looming deindustrialization, with Germany being hit the hardest.