https://en.sputniknews.africa/20230624/zambia-to-pay-1-interest-under-debt-relief-deal-reports-suggest-1060137119.html

Zambia to Pay 1% Interest Under Debt Relief Deal, Reports Suggest

Zambia to Pay 1% Interest Under Debt Relief Deal, Reports Suggest

Sputnik Africa

The Zambian government has recently announced that it reached an agreement to restructure $6.3 billion of its debt with bilateral lenders under the Group of 20... 24.06.2023, Sputnik Africa

2023-06-24T18:57+0200

2023-06-24T18:57+0200

2023-06-24T18:57+0200

sub-saharan africa

southern africa

zambia

g20

debt

debt restructuring

debt relief

international monetary fund (imf)

https://cdn1.img.sputniknews.africa/img/07e7/06/18/1060137877_0:0:3000:1688_1920x0_80_0_0_ef35d2fc6731316bbdf19a5c67169722.jpg

Zambia will be required to pay 1% interest rates until 2037 under the debt restructuring agreement secured with its bilateral creditors earlier this week, media has reported, citing sources close to negotiations. According to reports, the deal provides for an extension of maturities on $6.3 billion in bilateral debt until 2043. It specifies both a baseline and a contingent treatment, with the latter being introduced in case Zambia manages to improve its economic performance and policies so that it justifies an upgrade from "weak" to "medium" debt-carrying capacity. It was noted that rates will increase to a maximum 2.5% after 14 years under the baseline scenario. However, if the country is judged to be upgraded to a "medium" debt-carrying capacity, interest rates rise to a maximum 4%. At the same time, principal repayments are expected to start in 2026, at 0.5% or about $30 million annually, until 2035.The Zambian president announced the deal in Paris this week on the sidelines of the Summit for a New Global Financing Pact, held from June 22 to 23. The agreement is secured under the G20 Common Framework, a mechanism that offers a new approach to tackle sovereign debt of low-income countries, seeking to bring together traditional "Paris Club" creditors and lenders outside of it, including China and India.In 2020, Zambia became the first African nation since the beginning of the COVID-19 pandemic to announce a default on its $18.6 billion foreign debt. Since February 2021, the country has been seeking to restructure the debt under the framework for debt treatment co-chaired by Paris and Beijing.Following the announcement of the deal, Sputnik Africa sat down with an expert to discuss the significance of this development for the country. According to Hannah Ryder, CEO of Development Reimagined, although in the short run the debt restructuring will deliver some benefits, it's unclear whether it will definitely allow Zambia to ensure sustainable economic growth in the medium and long term.The deal marks the first major relief received by a developing state under the G20 mechanism. Along with Zambia, three other African nations requested debt treatment under the framework, including Chad, Ethiopia and Ghana.

https://en.sputniknews.africa/20230623/journey-towards-recovery-zambia-secures-debt-agreement-under-g20-framework-1060100932.html

southern africa

zambia

Sputnik Africa

feedback@sputniknews.com

+74956456601

MIA „Rossiya Segodnya“

2023

News

en_EN

Sputnik Africa

feedback@sputniknews.com

+74956456601

MIA „Rossiya Segodnya“

Sputnik Africa

feedback@sputniknews.com

+74956456601

MIA „Rossiya Segodnya“

southern africa, zambia, g20, debt, debt restructuring, debt relief, international monetary fund (imf)

southern africa, zambia, g20, debt, debt restructuring, debt relief, international monetary fund (imf)

Zambia to Pay 1% Interest Under Debt Relief Deal, Reports Suggest

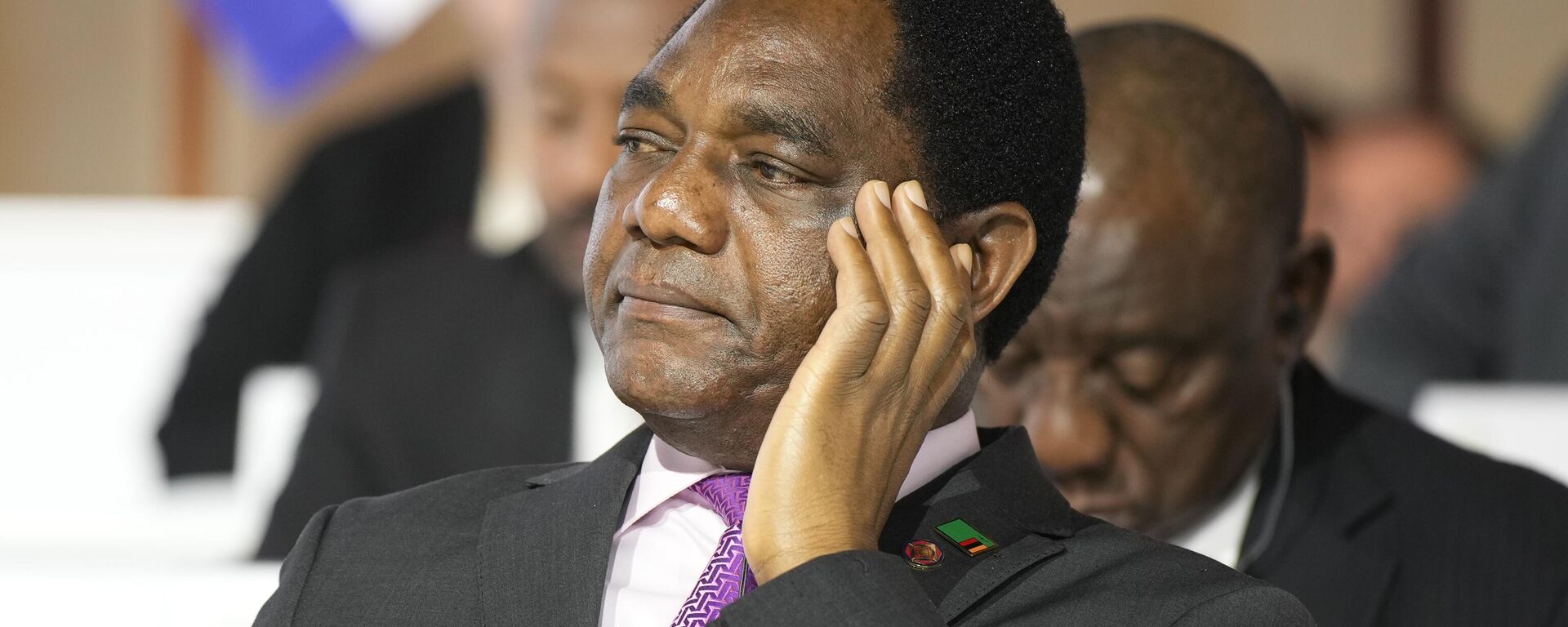

The Zambian government has recently announced that it reached an agreement to restructure $6.3 billion of its debt with bilateral lenders under the Group of 20 nations' Common Framework. President Hakainde Hichilema called the deal a major milestone on Zambia's path towards economic stability and growth.

Zambia will be required to pay 1% interest rates until 2037 under the debt restructuring agreement secured with its bilateral creditors earlier this week, media has reported, citing sources close to negotiations.

According to reports, the deal provides for an extension of maturities on $6.3 billion in bilateral debt until 2043. It specifies both a baseline and a contingent treatment, with the latter being introduced in case Zambia manages to improve its economic

performance and policies so that it justifies an upgrade from "weak" to "medium" debt-carrying capacity.

It was noted that rates will increase to a maximum 2.5% after 14 years under the baseline scenario. However, if the country is judged to be upgraded to a "medium" debt-carrying capacity, interest rates rise to a maximum 4%.

At the same time, principal repayments are expected to start in 2026, at 0.5% or about $30 million annually, until 2035.

The Zambian president

announced the deal in Paris this week on the sidelines of the Summit for a New Global Financing Pact, held from June 22 to 23. The agreement is secured under the G20 Common Framework, a mechanism that offers a new approach to tackle sovereign debt of low-income countries, seeking to bring together traditional "Paris Club" creditors and lenders outside of it, including China and India.

In 2020, Zambia became the first African nation since the beginning of the COVID-19 pandemic to announce a default on its $18.6 billion foreign debt. Since February 2021, the country has been seeking to restructure the debt under the framework for debt treatment co-chaired by Paris and Beijing.

"It was like a mission impossible," President Hichilema said Saturday upon his arrival at Zambia’s capital, Lusaka, adding: "It wasn't a straight line. It was zig-zag, sideways, forward, backwards, down, up. But we kept our eyes on the ball."

Following the announcement of the deal,

Sputnik Africa sat down with an expert to discuss the significance of this development for the country.

According to Hannah Ryder, CEO of Development Reimagined, although in the short run the debt restructuring will deliver some benefits, it's unclear whether it will definitely allow Zambia to ensure sustainable economic growth in the medium and long term.

The deal marks the first major relief received by a developing state under the G20 mechanism. Along with Zambia, three other African nations requested debt treatment under the framework, including Chad, Ethiopia and Ghana.