Beneficial 'On Paper' But Unclear in Long Term: Expert on Zambia's Debt Relief Deal

18:53 23.06.2023 (Updated: 10:44 03.08.2023)

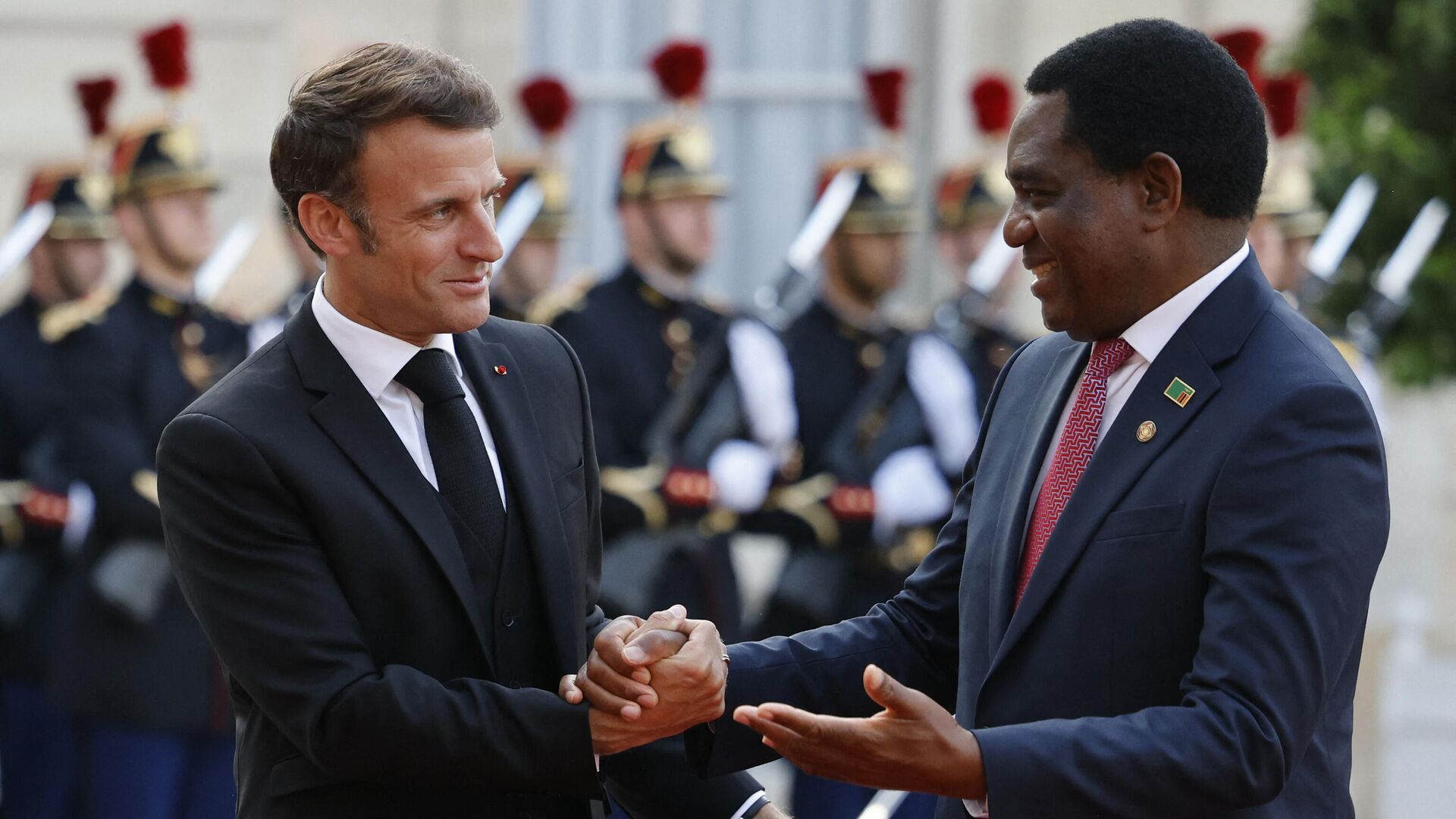

© AFP 2024 LUDOVIC MARIN

Subscribe

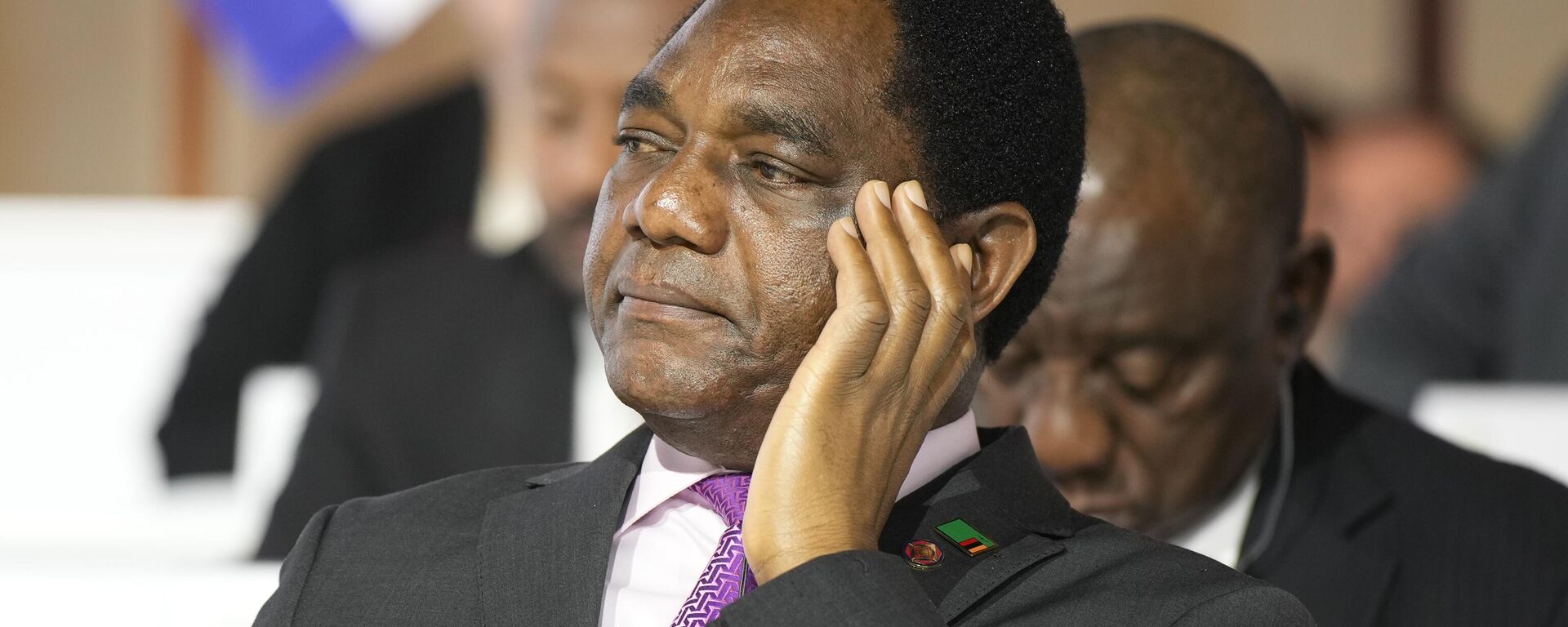

Earlier this week, Zambian President Hakainde Hichilema announced that the nation reached a long-awaited agreement on debt treatment with bilateral lenders. According to the president, the deal is a major milestone on Zambia's path towards economic stability and growth.

Even though the debt restructuring program is set to bring about certain benefits, including a release of funds for economic development, it poses certain threats due to the IMF prescriptions it entails, said Hannah Ryder, CEO of Development Reimagined and senior associate at the Africa Program of the Center for Strategic International Studies (CSIS), in an interview with Sputnik Africa.

Highlighting the significance of the agreement to the nation in general, Ryder pointed out that the restructuring is expected to create fiscal space for the government so that it can secure new financing for further development projects. It will release funds that could be spent on basic needs of the population, education, health or civil service, "just getting the government running."

Moreover, the nation will be "protected from being completely left out of future debt markets."

"No doubt that this restructuring means a lot for Zambia [...]. It is in principle and on paper a really good outcome. And it has been awaited for close to three years and it is about time that it has happened," she said.

However, Ryder recalled that the deal is brokered by the IMF and thus requires several adjustments in the country's economic policies in accordance with the financial institution's prescriptions. In particular, the Zambian citizens will have to face a reduction in fuel and food subsidies. She noted that in many countries, this kind of decision often causes protests and potentially may result in economic recession.

She added that the government could also be required to embark on "some degree of privatization" of the nation's major state-owned enterprises.

Apart from cuts in agricultural subsidies, the country may have to reduce other expenditures in order to meet the requirements of the IMF and therefore get the agreement in place. In particular, she pointed to the need to reconsider infrastructure programs. According to Ryder, this process has already begun, with several projects postponed or canceled in recent months.

"In the short term, it [the deal] could create benefits. But if the Zambian government is now cutting infrastructure projects, which are typically associated with economic growth and increasing economic growth, then that will be a significant problem," Ryder said.

Therefore, she concluded, although in the short run the debt restructuring will deliver some benefits, it's unclear whether it will definitely allow Zambia to ensure sustainable economic growth in the medium and long term.

The expert explained that by seeking debt restructuring under the G20 common framework, Zambia wanted to reduce the amount of debt servicing, as well as the overall amount of its debt. In this regard, Ryder emphasized that African nations are facing higher interest rates "than is really required and even relative to the rest of the world."

There is no information on whether the deal provides for a reduction of the debt's principal, but Zambian authorities "definitely have been able to reduce the payments that they will be making every year" and extend the maturities, in other words, to reduce the net present value of the debt.

She further elaborated that it means that the government can spend funds on other things while still servicing its debt.

Ryder added that the deal is expected to test the viability of this type of restructuring that requires implementation of the IMF program for such countries as Zambia, whether this kind of debt relief is "actually a right thing" for them.

"There are so many African countries [...] that have had to go through very difficult austerity due to IMF programs. And this is have been very difficult for them," she said.

Noting that this agreement could serve as a precedent for debt restructuring, she added that it may also make other nations seeking debt relief more reluctant to start this process and "go through the same pain that Zambia has." She recalled that the country had to wait a long time for this process to be completed. Furthermore, the agreement was reached only with bilateral creditors, including China, while the debt from the multilateral lenders, such as the World Bank or IMF, as well as private sector organizations remained intact.

"So there's still the whole process itself leaves a lot to be desired, especially in terms of coverage and also in terms of the amount of time it has taken just to make that progress," she summed up.