EAC Rebounds to $0.8B Trade Surplus as Exports Surge; Inflation Cools but Remains Elevated

17:32 08.08.2025 (Updated: 17:55 08.08.2025)

© telegram sputnik_africa

/ Subscribe

East African Community Rebounds to $0.8B Trade Surplus as Exports Surge; Inflation Cools but Remains Elevated

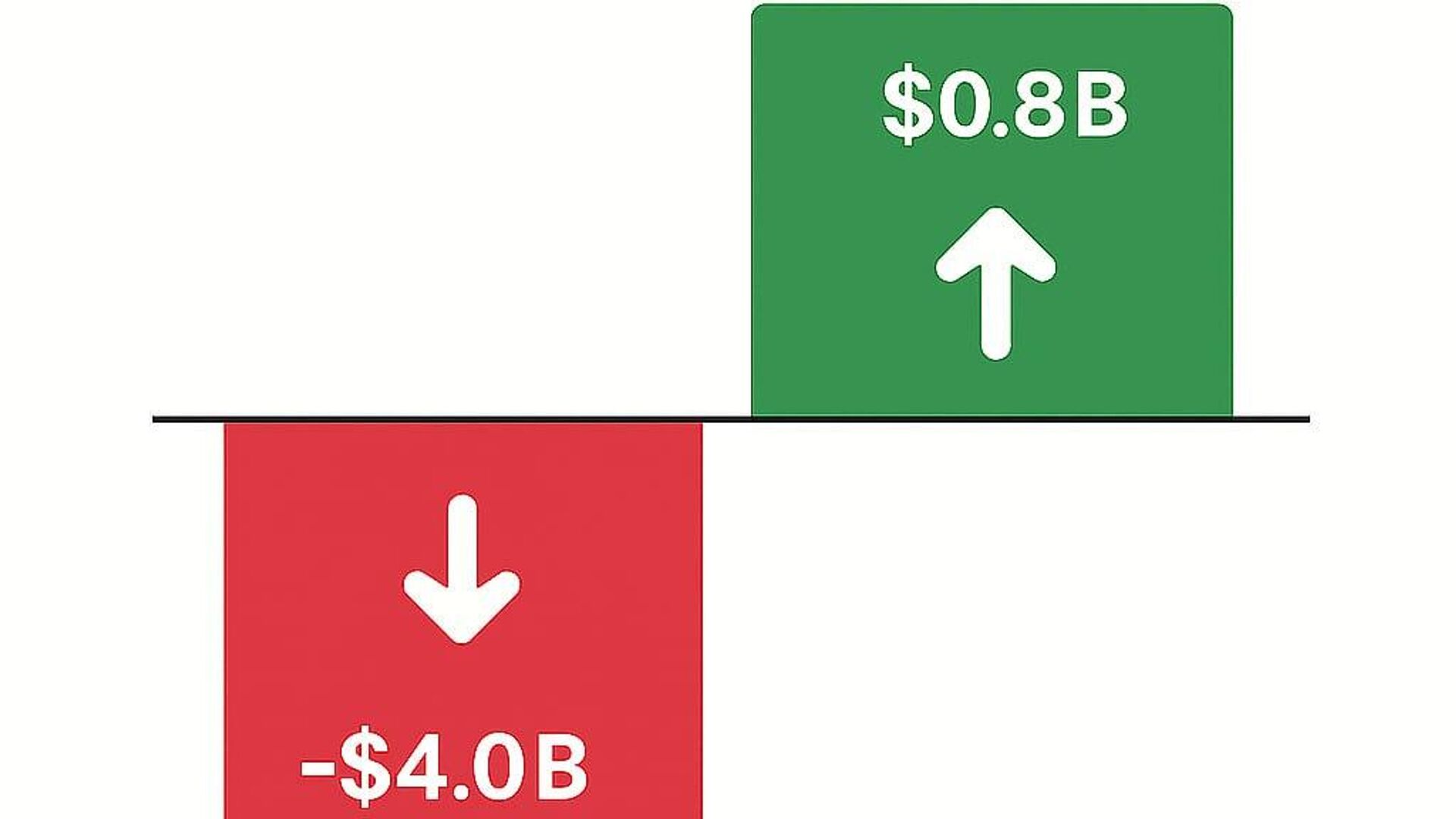

Major turnaround – Surplus of $0.8B vs. $4.0B deficit in Q1 2024.

Exports up sharply – +47.3% to $17.7B; imports rose 4.6% to $16.8B.

Domestic & re-exports – Domestic exports +48.1%; re-exports +32.4%.

Intra-African trade surge – +53.9% to $9.5B (27.5% of total trade); intra-EAC trade +53.6% to $5.2B.

China leads trade – Largest partner; $1.8B surplus with China for first time in recent years.

Top sectors – Base metals, minerals, agricultural goods, precious stones, and machinery made up over 50% of total trade value.

Inflation & Monetary Trends

Annual headline inflation: 27.0% in March 2025 (down from 30.6% in Feb; 6.7% in March 2024).

Food inflation: 49.4% in March (down from 55.6% in Feb).

Broad money supply: +10.1% in Q1 2025, driven by higher government credit (+21.1%).

Private sector credit: +5.5%; strong growth in construction (+17.5%) and wholesale/retail (+9.6%), but manufacturing nearly flat (+0.5%).

This positions the EAC for a stronger external trade outlook, though inflation pressures remain a key concern.

AI-generated image

Major turnaround – Surplus of $0.8B vs. $4.0B deficit in Q1 2024.

Exports up sharply – +47.3% to $17.7B; imports rose 4.6% to $16.8B.

Domestic & re-exports – Domestic exports +48.1%; re-exports +32.4%.

Intra-African trade surge – +53.9% to $9.5B (27.5% of total trade); intra-EAC trade +53.6% to $5.2B.

China leads trade – Largest partner; $1.8B surplus with China for first time in recent years.

Top sectors – Base metals, minerals, agricultural goods, precious stones, and machinery made up over 50% of total trade value.

Inflation & Monetary Trends

Annual headline inflation: 27.0% in March 2025 (down from 30.6% in Feb; 6.7% in March 2024).

Food inflation: 49.4% in March (down from 55.6% in Feb).

Broad money supply: +10.1% in Q1 2025, driven by higher government credit (+21.1%).

Private sector credit: +5.5%; strong growth in construction (+17.5%) and wholesale/retail (+9.6%), but manufacturing nearly flat (+0.5%).

This positions the EAC for a stronger external trade outlook, though inflation pressures remain a key concern.

AI-generated image