https://en.sputniknews.africa/20250220/nigeria-sues-binance-again-seeking-815-bln-for-alleged-economic-losses-and-tax-evasion-reports-1070741314.html

Nigeria Sues Binance Again, Seeking $81.5 Bln for Alleged Economic Losses and Tax Evasion: Reports

Nigeria Sues Binance Again, Seeking $81.5 Bln for Alleged Economic Losses and Tax Evasion: Reports

Sputnik Africa

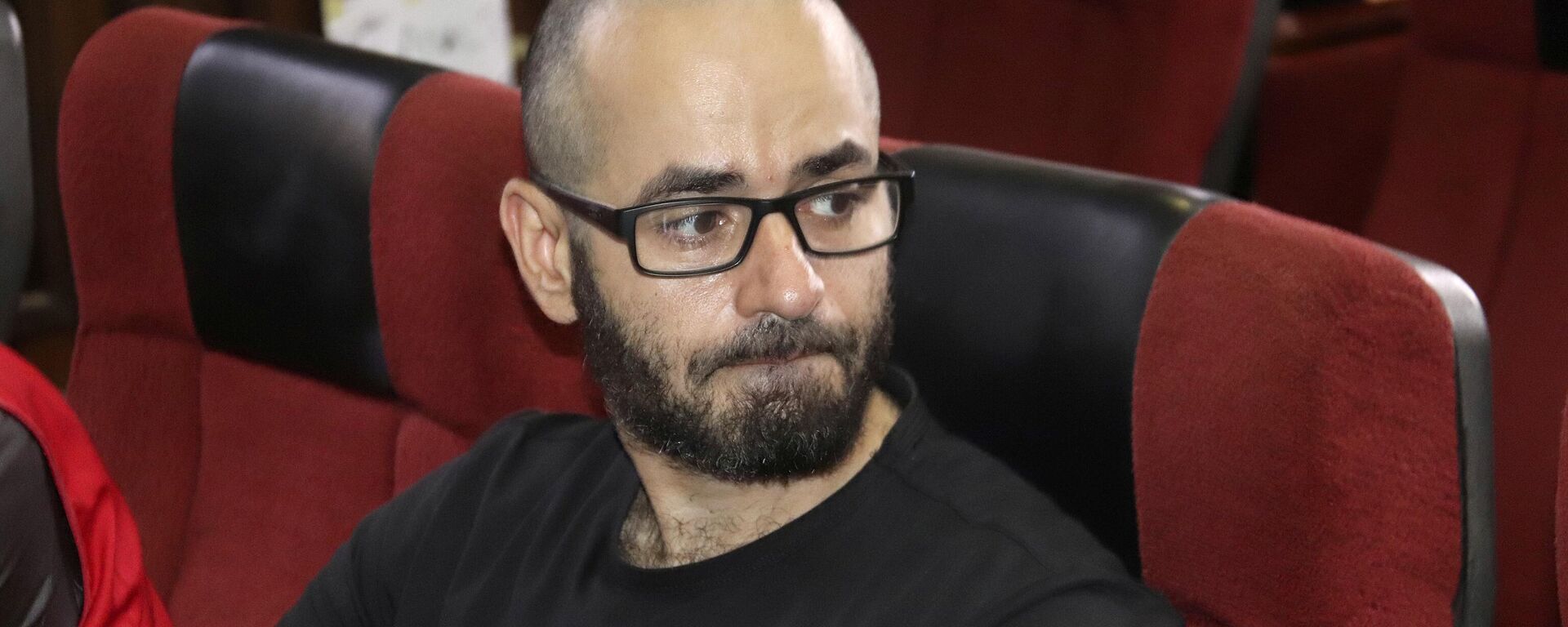

Binance cryptocurrency exchange and two of its executives, Tigran Gambaryan and Nadeem Anjarwalla, are reportedly accused of violating Nigerian laws, including... 20.02.2025, Sputnik Africa

2025-02-20T15:41+0100

2025-02-20T15:41+0100

2025-02-20T15:41+0100

sub-saharan africa

economy

nigeria

binance

west africa

tax evasion

taxes

court

justice

finance

https://cdn1.img.sputniknews.africa/img/07e9/02/14/1070741385_0:149:3111:1898_1920x0_80_0_0_5529b5be06f7a7d0d49391fb44cc113c.jpg

The Nigerian Federal Inland Revenue Service (FIRS) has filed the third lawsuit at the Federal High Court in Abuja against cryptocurrency exchange Binance, seeking $79.51 billion for alleged economic losses caused by its operations in Nigeria, as well as $2.001 billion in unpaid income taxes for 2022 and 2023, according to a lawsuit seen by local media.The cryptocurrency exchange is also accused of operating without necessary licenses, offering unauthorized financial services, and engaging in currency speculation, reports noted. An affidavit reportedly revealed that Binance operated in Nigeria for over six years without proper registration, with 386,256 active Nigerian users, a trading volume of $21.6 billion, and net revenue of $35.4 million in 2023. The lawsuit highlights Binance's alleged non-compliance with Nigeria's Significant Economic Presence Order, which mandates foreign companies earning at least ₦25 million (about $16,700) annually from digital services to register and pay taxes.

https://en.sputniknews.africa/20241023/nigeria-drops-all-charges-against-binance-executive-reports-say-1068842367.html

nigeria

west africa

abuja

Sputnik Africa

feedback@sputniknews.com

+74956456601

MIA „Rossiya Segodnya“

2025

News

en_EN

Sputnik Africa

feedback@sputniknews.com

+74956456601

MIA „Rossiya Segodnya“

Sputnik Africa

feedback@sputniknews.com

+74956456601

MIA „Rossiya Segodnya“

economy, nigeria, binance, west africa, tax evasion, taxes, court, justice, finance, cryptocurrencies , exchange, abuja

economy, nigeria, binance, west africa, tax evasion, taxes, court, justice, finance, cryptocurrencies , exchange, abuja

Nigeria Sues Binance Again, Seeking $81.5 Bln for Alleged Economic Losses and Tax Evasion: Reports

Elizaveta Roschina

Writer/Editor

Binance cryptocurrency exchange and two of its executives, Tigran Gambaryan and Nadeem Anjarwalla, are reportedly accused of violating Nigerian laws, including failing to register for tax compliance, causing economic harm, and breaching multiple regulatory frameworks such as the Companies Income Tax Act and the Money Laundering Act.

The Nigerian Federal Inland Revenue Service (FIRS) has filed the third lawsuit at the Federal High Court in Abuja against cryptocurrency exchange Binance, seeking $79.51 billion for alleged economic losses caused by its operations in Nigeria, as well as $2.001 billion in unpaid income taxes for 2022 and 2023, according to a lawsuit seen by local media.

The cryptocurrency exchange is also

accused of operating without necessary licenses, offering unauthorized financial services, and engaging in currency speculation, reports noted.

An affidavit reportedly revealed that Binance operated in Nigeria for over six years without proper registration, with 386,256 active Nigerian users, a trading volume of $21.6 billion, and net revenue of $35.4 million in 2023.

The lawsuit highlights Binance's alleged non-compliance with Nigeria's Significant Economic Presence Order, which mandates foreign companies earning at least ₦25 million (about $16,700) annually from digital services to register and

pay taxes.