https://en.sputniknews.africa/20240221/uganda-to-borrow-33-billion-for-next-fy-over-30-increase-from-last-year-1065185600.html

Uganda to Borrow $3.3 Billion for Next FY, Over 30% Increase From Last Year

Uganda to Borrow $3.3 Billion for Next FY, Over 30% Increase From Last Year

Sputnik Africa

Since the 2018/19 financial year, Uganda's public debt has increased by 111.7% due to "persistent budget deficits, rollover of liquidity papers, bond switches... 21.02.2024, Sputnik Africa

2024-02-21T14:32+0100

2024-02-21T14:32+0100

2024-02-21T14:43+0100

sub-saharan africa

uganda

economy

east africa

debt

finance minister

finance

government

https://cdn1.img.sputniknews.africa/img/07e8/02/15/1065188414_0:161:3070:1888_1920x0_80_0_0_b6e957be998f87eee9381d27be007781.jpg

The Government of Uganda plans to borrow just over Shs13 trillion (about $3.3 billion) from both domestic and external markets to finance the budget and projects in the 2024/25 financial year, an increase of about 31% compared to the planned domestic and external borrowings of Shs9.9 trillion (about $2.5 billion) for the 2023/2024 financial year.This amount (Shs13 trillion) exceeds the government's earlier projected borrowing by at least Shs1.5 trillion (approx. $3.9 million), according to the local media.In the Budget Framework Paper for the fiscal year 2024/2025, the Ministry of Finance stated that out of a total budget of Sh13 trillion, Sh8.9 trillion (about $2.3 billion) will be borrowed from external sources and Sh4.1 trillion (about $1 billion) will be domestic.Moreover, to avoid crowding out the private sector, the government will limit domestic borrowing to 1% of GDP over the medium term.Public debt increased to $23.66 billion in June 2023 (from $20.99 billion in June 2022), but fell to 46.9% of GDP, below the 50% threshold recommended by the International Monetary Fund for low-income countries.Despite some positive results, the Ministry of Finance stated that external debt payments are expected to rise in the medium term due to the recent increase in commercial loans, noting that interest payments will total Shs7.6 trillion (more than $1.9 billion), equivalent to 3.5% of GDP.Of the total interest payments, Shs5.6 trillion (around $1.4 billion) will go towards domestic debt interest payments, while Shs1.9 trillion (approx $490 million) will go towards foreign interest payments and commitment fees.The ministry also stated that interest payments are expected to fall to an average of 3% of GDP in the medium term.Furthermore, the document highlighted that the government's primary focus is to reduce public debt to below 50% by fiscal year 2024/25 to keep it at a sustainable level.However, there are risks to the economic recovery from domestic and global factors that could impact growth projections and revenue collection.This report highlighted the importance of sound economic planning, echoing the words of Ugandan Finance Minister Matia Kasaija, who reportedly said in early February, at a pre-budget dialogue for the 2024/25 financial year, that he cannot continue to borrow money indefinitely to "mortgage the country" by financing endless financial requests, many of which could be deferred or even canceled, and urged the government to prioritize certain sectors of the economy since there'll "never be enough" money for every sector.

https://en.sputniknews.africa/20240205/ugandan-finance-minister-says-he-cant-borrow-indefinitely-to-mortgage-country-1064941946.html

uganda

east africa

Sputnik Africa

feedback@sputniknews.com

+74956456601

MIA „Rossiya Segodnya“

2024

Christina Glazkova

https://cdn1.img.sputniknews.africa/img/07e7/0b/07/1063380906_0:0:673:674_100x100_80_0_0_79628b4d0cd9f29291a57aa13bbf9e7a.jpg

Christina Glazkova

https://cdn1.img.sputniknews.africa/img/07e7/0b/07/1063380906_0:0:673:674_100x100_80_0_0_79628b4d0cd9f29291a57aa13bbf9e7a.jpg

News

en_EN

Sputnik Africa

feedback@sputniknews.com

+74956456601

MIA „Rossiya Segodnya“

Sputnik Africa

feedback@sputniknews.com

+74956456601

MIA „Rossiya Segodnya“

Christina Glazkova

https://cdn1.img.sputniknews.africa/img/07e7/0b/07/1063380906_0:0:673:674_100x100_80_0_0_79628b4d0cd9f29291a57aa13bbf9e7a.jpg

uganda, economy, east africa, debt, finance minister, finance, government

uganda, economy, east africa, debt, finance minister, finance, government

Uganda to Borrow $3.3 Billion for Next FY, Over 30% Increase From Last Year

14:32 21.02.2024 (Updated: 14:43 21.02.2024) Christina Glazkova

Writer / Editor

Since the 2018/19 financial year, Uganda's public debt has increased by 111.7% due to "persistent budget deficits, rollover of liquidity papers, bond switches, private placements, new borrowings for various development projects and foreign exchange loss," according to the Supreme Audit Institution of Uganda.

The Government of Uganda plans to borrow just over Shs13 trillion (about $3.3 billion) from both domestic and external markets to finance the budget and projects in the 2024/25 financial year, an increase of about 31% compared to the

planned domestic and external borrowings of Shs9.9 trillion (about $2.5 billion) for the 2023/2024 financial year.

This amount (Shs13 trillion) exceeds the government's earlier projected borrowing by at least Shs1.5 trillion (approx. $3.9 million), according to the local media.

In

the Budget Framework Paper for the fiscal year 2024/2025, the Ministry of Finance stated that out of a total budget of Sh13 trillion, Sh8.9 trillion (about $2.3 billion) will be borrowed from external sources and Sh4.1 trillion (about $1 billion) will be domestic.

Moreover, to avoid crowding out the private sector, the government will limit domestic borrowing to 1% of GDP over the medium term.

Public debt increased to $23.66 billion in June 2023 (from $20.99 billion in June 2022), but fell to 46.9% of GDP, below the 50% threshold recommended by the International Monetary Fund for low-income countries.

"[...] The continued economic growth recovery from the COVID-19 shock, which had not only affected economic activity, but also necessitated higher Government borrowing, coupled with Government’s deliberate efforts towards fiscal consolidation" helped reduce public debt in terms of its share of GDP, according to the document.

Despite some positive results, the Ministry of Finance stated that

external debt payments are expected to rise in the medium term due to the recent increase in commercial loans, noting that interest payments will total Shs7.6 trillion (more than $1.9 billion), equivalent to 3.5% of GDP.

Of the total interest payments, Shs5.6 trillion (around $1.4 billion) will go towards domestic debt interest payments, while Shs1.9 trillion (approx $490 million) will go towards foreign interest payments and commitment fees.

The ministry also stated that interest payments are expected to fall to an average of 3% of GDP in the medium term.

Furthermore, the document highlighted that the government's primary focus is to reduce public debt to below 50% by fiscal year 2024/25 to keep it at a sustainable level.

However, there are risks to the economic recovery from domestic and global factors that could impact growth projections and revenue collection.

"Monetary policy tightening in developed economies [...] may lead to a significant depreciation of the shilling against the dollar, which would affect the cost of external debt servicing and imports, the Ministry of Finance, said, noting that it may also lead to a significant increase in domestic interest rates due to the exit of offshore investors to markets in developed economies which are perceived to be safe," the Budget Framework Paper said.

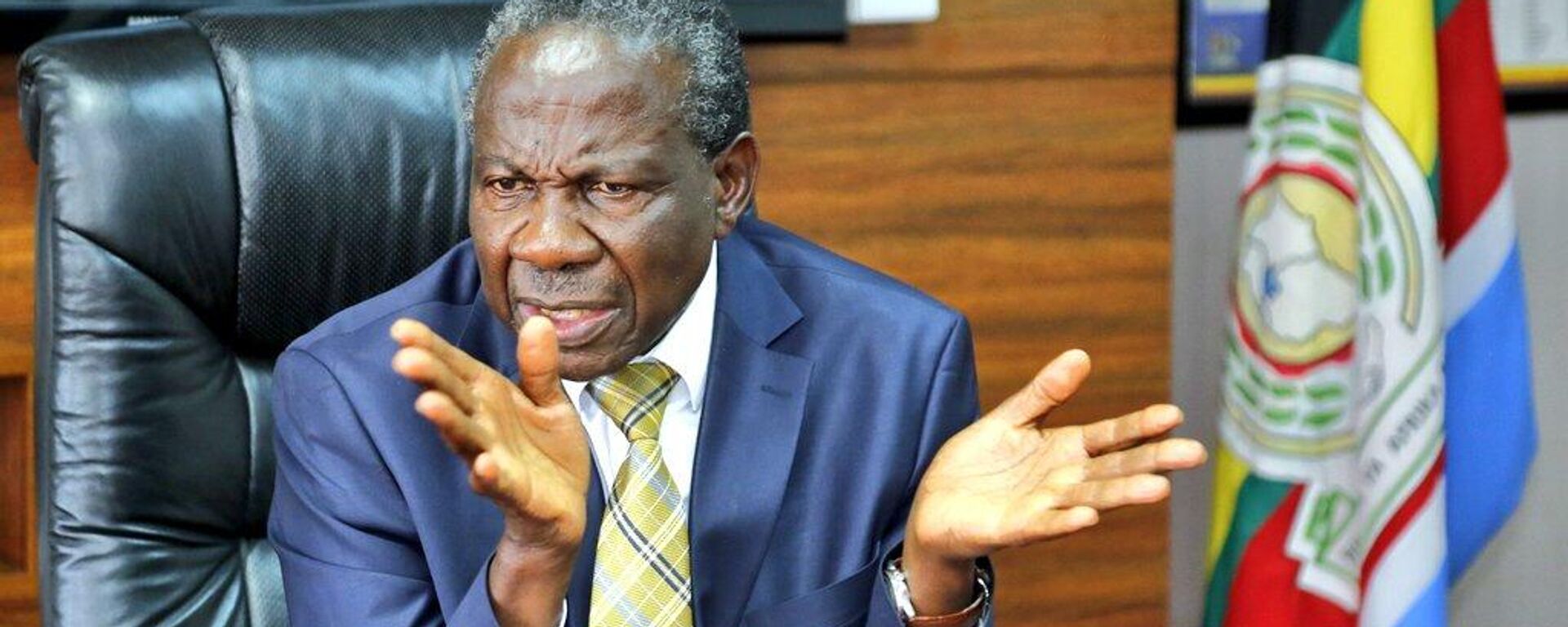

This report highlighted the importance of sound economic planning, echoing the words of Ugandan Finance

Minister Matia Kasaija, who reportedly said in early February, at a pre-budget dialogue for the 2024/25 financial year, that he cannot continue to borrow money indefinitely to "mortgage the country" by financing endless financial requests, many of which could be deferred or even canceled, and urged the government to prioritize certain sectors of the economy since there'll "never be enough" money for every sector.