https://en.sputniknews.africa/20240111/central-bank-of-nigeria-dissolves-boards-of-three-banks-for-non-compliance-with-law-1064576476.html

Central Bank of Nigeria Dissolves Boards of Three Banks for 'Non-Compliance' With Law

Central Bank of Nigeria Dissolves Boards of Three Banks for 'Non-Compliance' With Law

Sputnik Africa

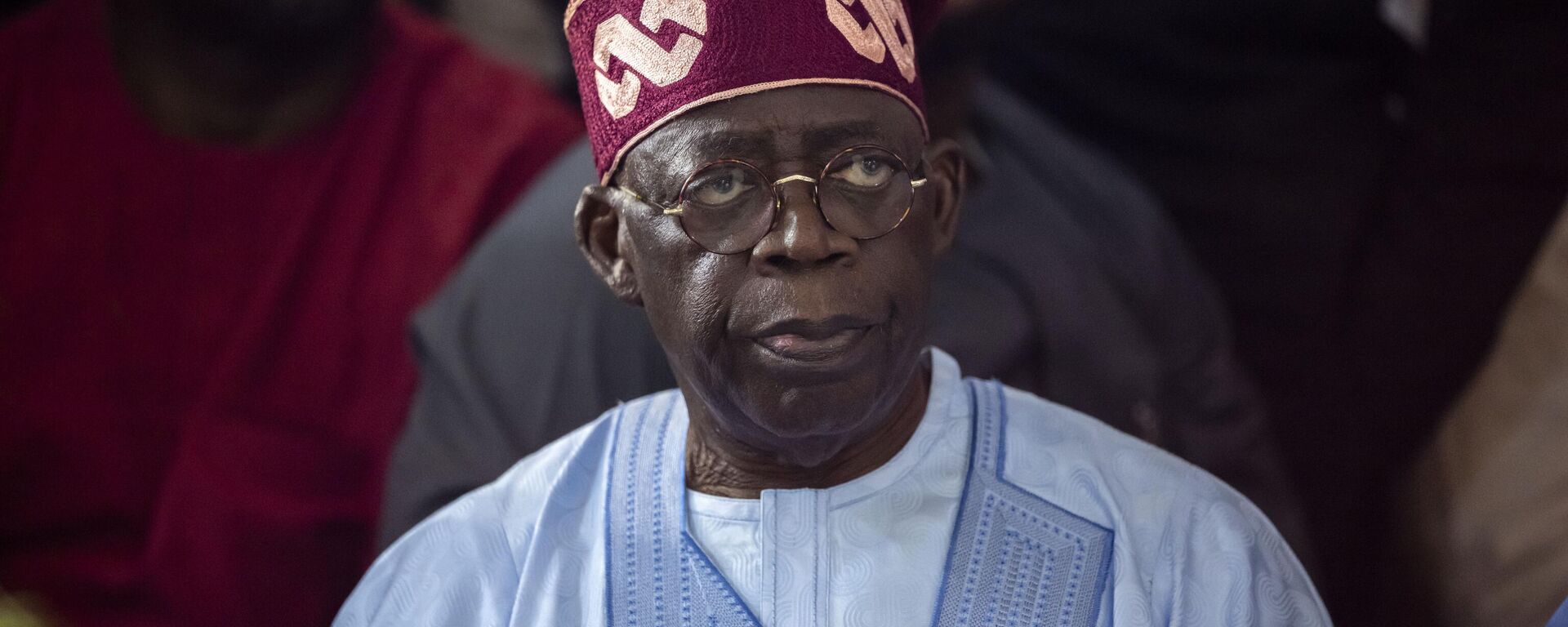

The action was taken on the recommendation of Jim Obazee, a special investigator appointed by President Bola Tinubu in July 2023 to look into the financial... 11.01.2024, Sputnik Africa

2024-01-11T17:43+0100

2024-01-11T17:43+0100

2024-01-11T17:59+0100

sub-saharan africa

nigeria

bola tinubu

economy

central bank

west africa

bank

finance

fraud

https://cdn1.img.sputniknews.africa/img/07e7/09/16/1062287530_0:257:2730:1793_1920x0_80_0_0_5ac511ef1ef8d30da32e22c67015bad7.jpg

The Central Bank of Nigeria (CBN) said it had sacked the boards and management of Union Bank, Keystone Bank and Polaris Bank for failing to comply with the provisions of the Banks and Other Financial Institutions Act.The board of the three lenders also ignored the terms of their licenses and engaged in activities that posed a threat to financial stability, the CBN added.The Central Bank also announced in the statement that it has already appointed replacement managers in the banks and assured citizens of the safety of their deposits.In late December, the Nigerian government reportedly said that it was on the verge of recovering Union Bank and Keystone Bank after an investigation revealed that former Central Bank Governor Godwin Emefiele had acquired them through several proxies.The report, according to the media, revealed that Emefiele, who was sacked by President Bola Tinubu in June, bribed two creditors with "ill-gotten wealth" and "without evidence of payment."The sacking of the boards comes under the tenure of Emefiele's successor, Central Bank governor Olayemi Cardoso, who was appointed in September and has ordered lenders in the West African nation to increase capital levels.

https://en.sputniknews.africa/20240109/nigerias-tinubu-suspends-humanitarian-minister-in-wake-of-financial-investigation-1064531386.html

nigeria

west africa

Sputnik Africa

feedback@sputniknews.com

+74956456601

MIA „Rossiya Segodnya“

2024

Maxim Grishenkin

https://cdn1.img.sputniknews.africa/img/07e7/0a/17/1063018107_0:0:1104:1103_100x100_80_0_0_03090c85a11f5d2e8a19cf1d989443c9.jpg

Maxim Grishenkin

https://cdn1.img.sputniknews.africa/img/07e7/0a/17/1063018107_0:0:1104:1103_100x100_80_0_0_03090c85a11f5d2e8a19cf1d989443c9.jpg

News

en_EN

Sputnik Africa

feedback@sputniknews.com

+74956456601

MIA „Rossiya Segodnya“

Sputnik Africa

feedback@sputniknews.com

+74956456601

MIA „Rossiya Segodnya“

Maxim Grishenkin

https://cdn1.img.sputniknews.africa/img/07e7/0a/17/1063018107_0:0:1104:1103_100x100_80_0_0_03090c85a11f5d2e8a19cf1d989443c9.jpg

nigeria, bola tinubu, economy, central bank, west africa, bank, finance, fraud

nigeria, bola tinubu, economy, central bank, west africa, bank, finance, fraud

Central Bank of Nigeria Dissolves Boards of Three Banks for 'Non-Compliance' With Law

17:43 11.01.2024 (Updated: 17:59 11.01.2024) The action was taken on the recommendation of Jim Obazee, a special investigator appointed by President Bola Tinubu in July 2023 to look into the financial misconduct of the banks, according to local media.

The Central Bank of Nigeria (CBN) said it had sacked the boards and management of Union Bank, Keystone Bank and Polaris Bank for failing to comply with the provisions of the Banks and Other Financial Institutions Act.

The board of the three lenders also ignored the terms of their licenses and engaged in activities that posed a threat to financial stability, the CBN added.

The Central Bank

also announced in the statement that it has already appointed replacement managers in the banks and assured citizens of the safety of their deposits.

"The CBN assures the public of the safety and security of depositors' funds and remains resolute in fulfilling its mandate to uphold a safe, sound, and robust financial system in Nigeria. Our Banking system remains strong and resilient," the statement said.

In late December, the Nigerian government reportedly said that it was on the verge of recovering Union Bank and Keystone Bank after an investigation revealed that former Central Bank Governor Godwin Emefiele had acquired them through several proxies.

The report, according to the media, revealed that Emefiele, who was sacked by President Bola Tinubu in June, bribed two creditors with "ill-gotten wealth" and "without evidence of payment."

The sacking of the boards comes under the tenure of Emefiele's successor, Central Bank governor Olayemi Cardoso, who

was appointed in September and has ordered lenders in the West African nation to increase capital levels.