IMF & World Bank 'Continue to Fail' Africa: Economist on Financing and Combating Climate Change

11:50 10.12.2023 (Updated: 12:44 10.12.2023)

CC BY 2.0 / PAUL SAAD /

Subscribe

Longread

Last week, the pan-African media African Arguments published an article titled "Two IMF fixes that could channel billions to Africa," exploring inequality in IMF asset allocation. Sputnik Africa reached out the author of the article to discuss the interaction between Western financial institutions and Africa, and alternatives to their assistance.

While the IMF functions as a lender of last resort to countries in crisis, and the World Bank provides substantial financing to low- and middle-income countries, neither institution adequately addresses the needs of African countries, as Estehiwot Kebret, Development Finance Advisor at Development Reimagined, told Sputnik Africa.

A major problem is the cautious approach of multilateral development banks (MDBs), including the World Bank, attributed by Kebret to their concern for credit ratings. This caution limits MDBs' ability to take on more risk, resulting in limited lending and financial support to African countries.

In addition, she noted that the World Bank, tasked with providing loans for infrastructure, "has not funded a rail route on the continent since 2002."

"So if the bank is not financing projects that are needed, then the bank is not really doing its job efficiently. And what that does mean is that it's not really a reliable partner for the African continent," the analyst said, adding that the executive boards of such institutions "don't even have adequate representation of African countries."

Additionally, she emphasized the bias of Debt Sustainability Analysis (DSA), a tool used by the IMF and World Bank for assessing a country's debt crisis. She explained that DSA, which ranks countries by risk based on their debt-to-GDP ratio, neglects important things like whether the government is investing the country's debt in necessary infrastructure, resulting in the labeling of several African countries as high rish and deterring investors.

"What this shows really is that the international financial system and these institutions, the World Bank, the IMF, including other MDBs really in this case, continue to fail the African continent," Kebret opined.

The economist also delved into the Special Drawing Rights (SDR), an international reserve asset comprising IMF currencies: the US dollar, the pound sterling, the euro, the Japanese yen and the Chinese yuan. In 2021, the IMF announced a historic global SDR allocation valued at $650 billion.

While SDR is a valuable financial instrument with no conditions, giving recipients the right to exchange the asset for any of the five currencies, and can be used to repay debt, only $33 billion of the $650 billion SDRs allocated in 2021 has been directed to Africa.

Noting that the rich countries which receive the most of SDRs have billions of unused assets. She cited France proposing to the G20 countries to reallocate 100 billion of their unused SDRs, in an agreement that reached later. However, only a small portion of these disbursements, mainly through the IMF's Poverty Reduction Growth Trust and Resilience and Sustainability Trust, have gone to African countries, the finance advisor noted.

"If we look at, let's say, figures from 2021 to 2022, African countries only received 10.9 billion through the Poverty Reduction Growth trust. And so from all these different scenarios, what we're seeing is that these international responses are just not adequate," Kebret pointed out.

Addressing this, Kebret suggested a hybrid capital instrument proposed by the African Development Bank (AfDB), utilizing rich countries' contributions to SDRs to better meet the Africa's financing needs through grants.

According to Kebret, AfDB, representing the continent, understands Africa's needs and can potentially increase the size of the deposit by 3–4 times.

"African financial institutions always need to be supported when it comes to spurring development and growth on the continent, because really they know where the needs are. They know which projects need the most financing and therefore, it only makes sense that they should be the ones that receive the most financing," she stressed, adding that the AfDB has a "very great reputation for delivering results."

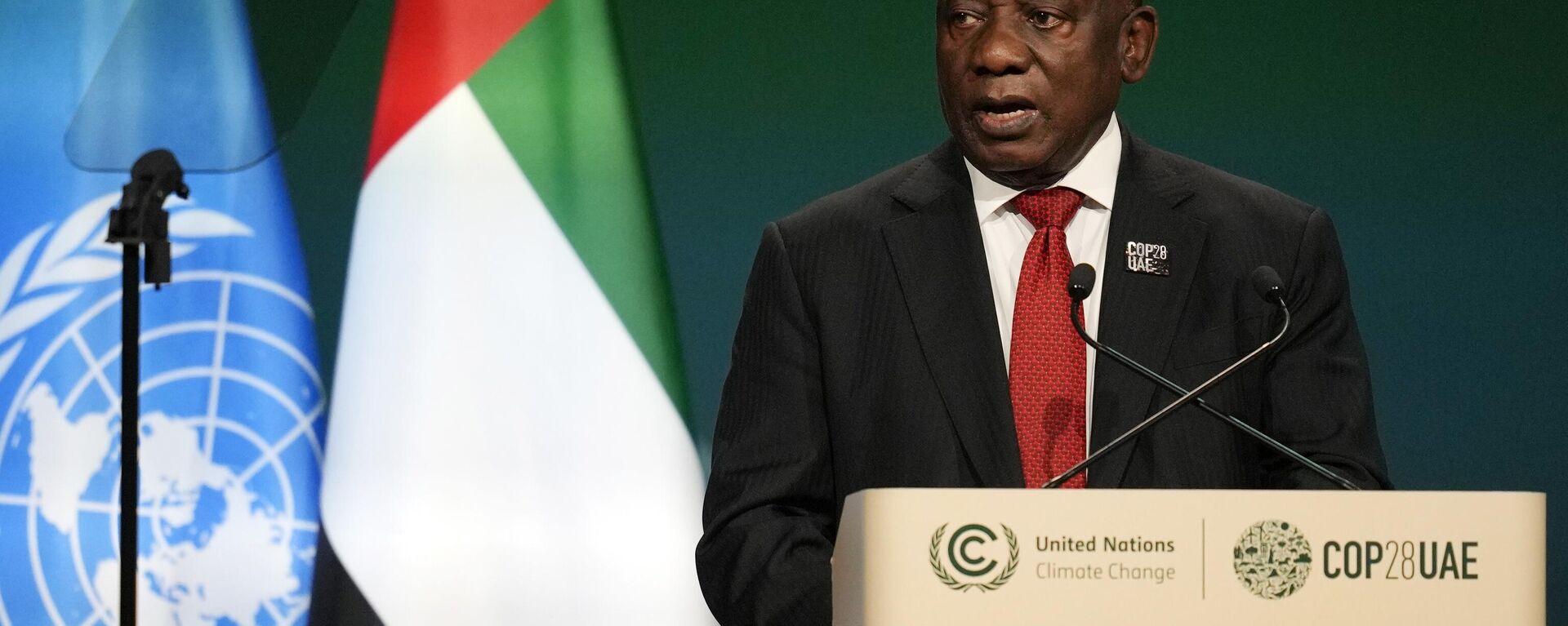

COP28 & Climate Change

Kebret noted that the African Development Bank has played a critical role and can play an even greater one in providing new climate finance to the continent, through the SDRs, but lamented that the ongoing COP28 negotiations in Dubai did not include an official contribution from rich countries to the hybrid capital instrument.

"I still think that high income countries can do a bit more and commit more when it comes to climate finance and also supporting really important innovative mechanisms, like SDRs," she said.

The finance advisor explained that African countries contribute the least to climate change, but are also the most vulnerable to its effects, which is "so unfortunate."

The $700 million Loss and Damage Fund created during COP27 in Egypt is being used to assist countries suffering the most from climate-related devastation, but its funding is far from sufficient to fulfill its stated purpose, the analyst revealed.

"$700 million is a start, but it's really nowhere near enough, unfortunately," Kebret emphasized. "There are estimates that the annual cost of the damage caused by climate disasters ranges between $100 billion to $580 billion. So the amounts that are pledged are barely enough to even get the fund running."

The economist said that more funding is needed from developed countries, including the United States, a major emitter of greenhouse gases, to help countries suffering from climate change.

She also called on international financial institutions to play a greater role in helping Africa and other developing countries combat climate change. Citing AfDB figures, Africa will need approximately $2.8 trillion by 2030 to meet the climate commitments which made under the 2015 Paris Agreement.

"So that number really should illustrate in people's minds how much is needed and how much is at stake," Kebret said. "[...] MDBs cannot and should not feel comfortable being as risk averse as they are, as they have been for all these years."

In addition, the new BRICS development bank could be used to obtain the necessary financing, the expert said, asserting that with the right support, African countries can "truly harness their potential, that they can effectively use their resources and meet the Sustainable Development Goals, as well as other continental development goals, such as Agenda 2063."

COP28, running through December 12, gathers world leaders, global organizations, and stakeholders to negotiate and collaborate in the fight against climate crisis.